It was published in the journal Synergies - Italian Journal of Management the article "Shareholder engagement and co-creation. An analysis on a sample of listed companies', written by six hands by Prof. Salvatore Esposito De Falco (la Sapienza), Nicola Cucari (University of Salerno) and Sergio Carbonara (Frontis Governance), Best Paper Award at the 2017 Sinergie-SIMA Conference.

Through the analysis of institutional investors' voting at ordinary shareholders' meetings held in the three-year period 2014-2016, the study proves how companies that initiate an ongoing dialogue with their shareholders (and not only in the run-up to the shareholders' meeting) create the preconditions for shared governance and a broad consensus at the shareholders' meeting.

The analysis considers a sample of 42 Italian listed companies, representative of both the composition of the list (in particular by capitalisation and share structure) and engagement practices. The sample was divided into three categories:

- 21 companies that did not no engagement activities with institutional investors or their proxyadvisors during the reference period;

- 11 companies that carried out engagement exclusively in the run-up to the assemblyclearly aimed at obtaining a favourable vote on certain proposals;

- 10 companies that have undertaken activities and/or adopted a policy of continuous dialogue with investors (generally on several occasions, starting in September/October until the publication of the meeting notice), and thus not aimed solely at the approval of meeting proposals but at improving governance practices.

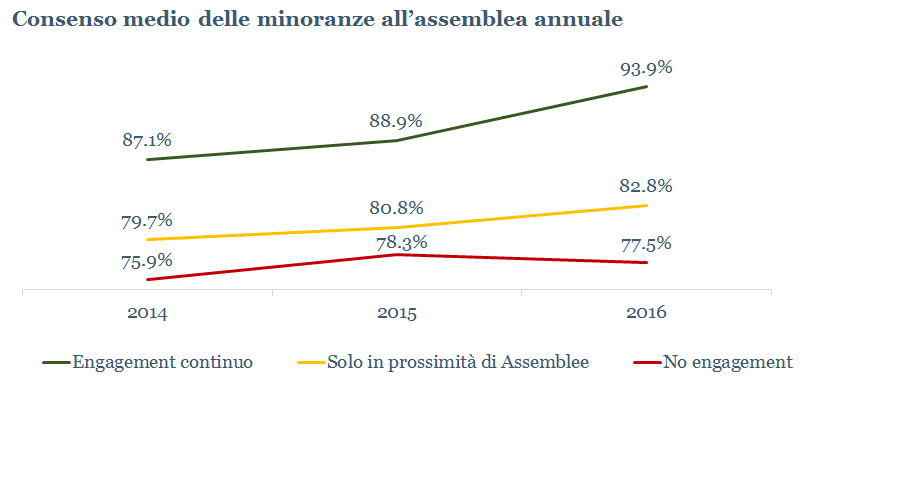

The analysis started from the vote of institutional investors on all resolutions submitted to the ordinary shareholders' meeting, showing that companies that engage in some kind of engagement (either in the run-up to the shareholders' meeting or on an ongoing basis) obtain higher approval rates on average and consistently increase over the period considered.

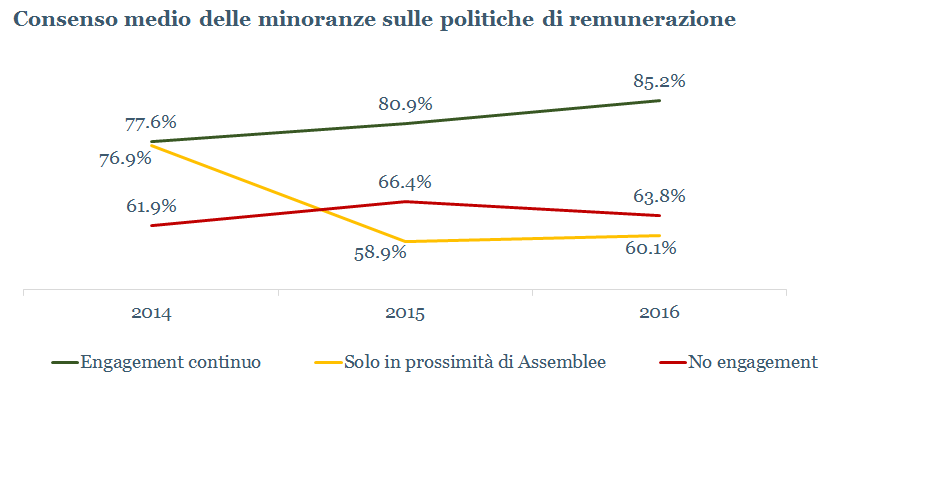

The study then focused on the remuneration policieswhich is a particularly controversial topic and on which most of the engagement activities carried out in the run-up to the shareholders' meeting focus. In this case, companies that engage in continuous dialogue with their shareholders not only achieve the highest approval rates, but are also the only ones where approval is constantly increasing. On the other hand, companies that do not engage in any kind of engagement and those that engage only in the run-up to the shareholders' meeting (and therefore without this activity having any influence on the proposed policies) show a fluctuating trend in approval. Companies that only activate close to the AGM even reported the highest average level of dissent in both 2015 and 2016.

The study therefore shows how important it is to have an open dialogue with one's shareholders, not only to clarify shareholders' meeting proposals and remuneration policies already defined by management and the Board, but to define shared practices that can guarantee optimal governance conditions and a real alignment of interests in the long term.